0 Comments

1 category

Deductible Business Expenses 2024 – Discover how self-employed individuals and employees can claim cellphone expenses as a tax deduction, and how the rules have changed over the years. . Taking advantage of these often overlooked tax deductions can help you lower your tax bill. .

Deductible Business Expenses 2024

Source : www.freshbooks.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.comThe Ultimate 2024 Tax Deductions Checklist for Insurance Agents

Source : blog.newhorizonsmktg.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.comSmall Business Tax Deductions Checklist 2024 Blog Akaunting

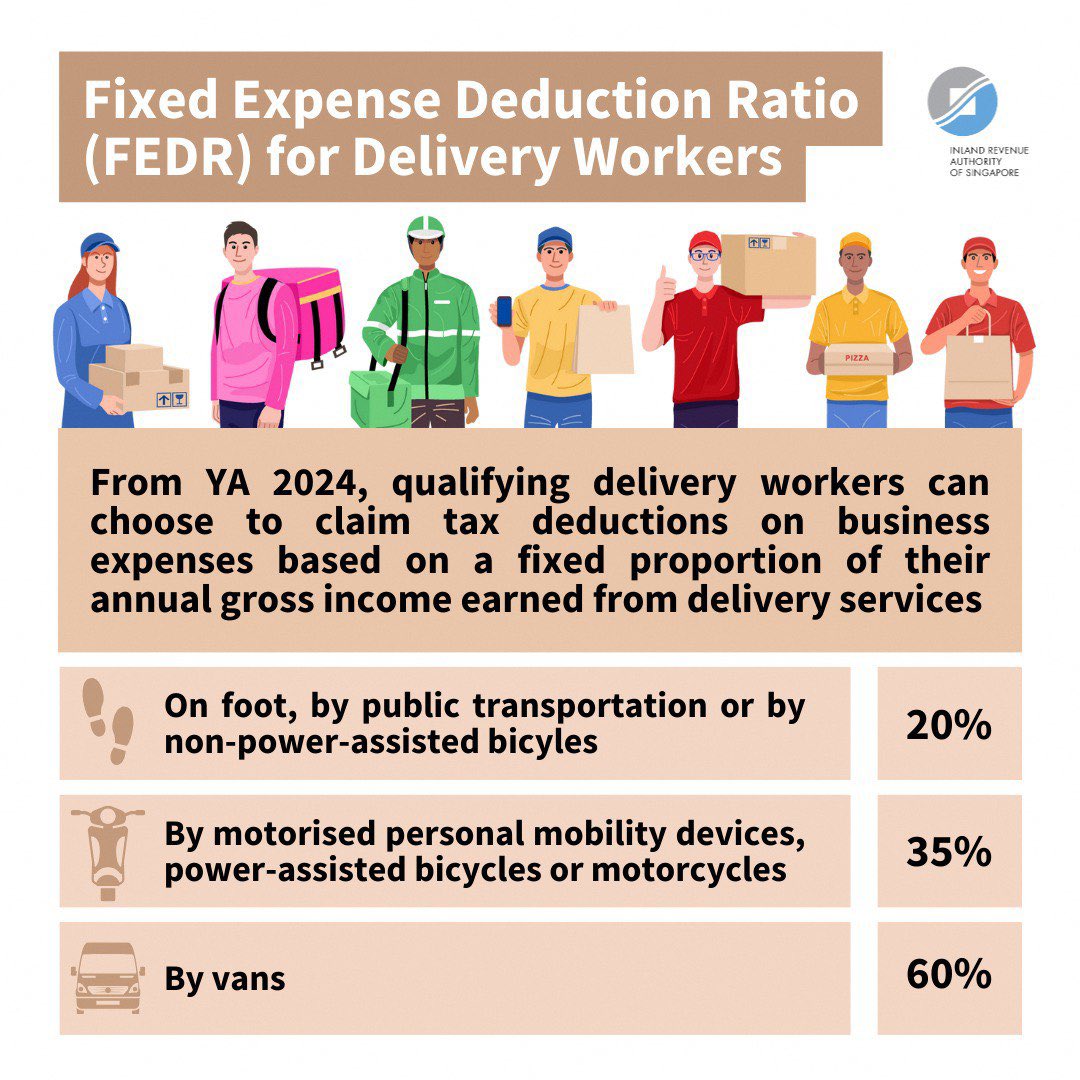

Source : akaunting.comIRAS on X: “Good news for delivery workers! 🙌🏻 With effect from

Source : twitter.com22 Small Business Tax Deductions Checklist For Your Return In 2024

Source : www.insureon.com🚀 Elevate your freelance game Freelancers in Belgium | Facebook

Source : m.facebook.comTravel Expenses for Small Business Owners | Castro & Co. [2024]

Source : www.castroandco.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.comDeductible Business Expenses 2024 25 Small Business Tax Deductions To Know in 2024: Taxpayers often push the limits to save on their taxes. Here are some unusual deductions the IRS has allowed taxpayers to take. Do any pertain to you? . There are many deductions you can claim as a freelance worker. But read on for a list of expenses that won’t fly with the IRS. .

]]> Category: 2024